Efficient | Hedged | Uncorrelated

Asset Management

Limitless Capital is a relative-value fund specializing in options-based strategies across equity markets

Principles

EFFICIENT

Our strategy emphasizes efficient capital deployment through structured options positioning

HEDGED

We manage risk through deliberate portfolio-level hedging to reduce sensitivity to market movements

UNCORRELATED

We seek returns primarily driven by option market dynamics rather than broad market direction

OUR values

transparency

We emphasize transparent reporting and disciplined valuation practices to help investors understand how capital is deployed, risk is managed, and economic value is created

integrity

We emphasize process discipline and risk controls to ensure returns are generated through repeatable strategy execution, not opportunistic risk-taking

collaboration

We emphasize collaborative decision-making and open communication to challenge assumptions, improve risk assessment, and strengthen execution

success factors

research and development

We invest continuously in research and analytics to refine our options framework, improve execution, and adapt responsibly to evolving market conditions

strategic focus

Our long-term vision emphasizes sustainable value creation, supported by near-term decisions anchored in our guiding principles and investment framework

Dedicated approach

We employ a systematic investment process in which options are the primary instruments used to express views informed by fundamentals, volatility, and risk-reward analysis

Justin Roopnarine

- Managing Partner

- B.S. Electrical Engineering

- M.S. Mathematical Finance

Board of Advisors

Melissa Fay

Head of Capital Markets of Drexel Hamilton, LLC

MBA UC Berkeley Haas School of Business

M.S. in Mechanical Engineering - The Johns Hopkins University

United States Naval Academy Graduate

Kutay Tumay

Founder & Director of Comunicare Engineering and Consultancy Ltd.

M.S.c Electrical Engineering - Coventry University

BSC Strategy U.K. Award Winner

Giulio Sartori

Partner & Project Manager of Globify Bank

Harvard Business Graduate- Strategy, Finance, and Accounting

B.A. in International Business - Munich Business School

Partners

Strategy

IDENTIFY

We identify fundamentally sound securities that meet our liquidity, volatility, and risk criteria

ANALYZE

We evaluate option pricing, volatility dynamics, and risk-reward characteristics to structure favorable trades

MONITOR

We continuously monitor positions and market conditions to manage risk and adjust exposures as needed

We deliver efficient, hedged, and uncorrelated asset management through a disciplined, repeatable, options-focused investment approach

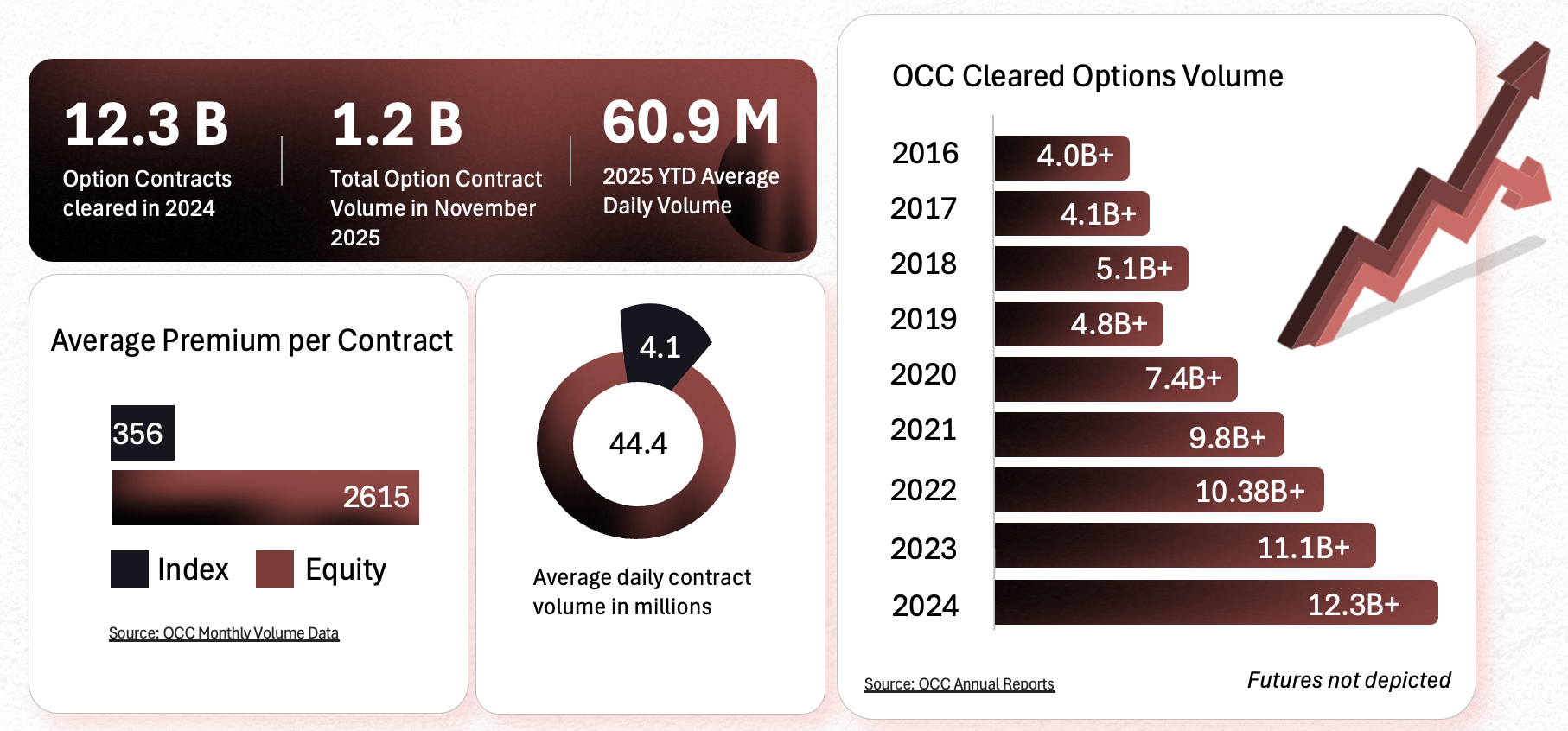

The U.S. equity options market has expanded significantly in both depth and liquidity, creating a persistent opportunity to systematically generate returns through option premium. As illustrated below, the scale and structure of this market support repeatable, risk-managed strategies designed to capture economic value across market environments

Complete the form below to get in touch with us!

- Copyright 2025 © All rights Reserved.

- Legal Disclaimer